The most important step in doing a budget is to set a goal. This is the most important step of all because it will keep you motivated and help you stay on track. When creating a budget, it is important to have a plan and a goal to achieve. You will need to identify your spending and income, and you should include all of them. A budget is helpful in tracking spending, as well as identifying savings and investments.

Once you have a set goal, you can start creating a budget. Begin by listing all of your fixed expenses. You should first list out all of your necessities and wants. Then, list down all your flexible costs. This means that you should allocate 30% of your income to fixed expenses. If you don’t have an emergency fund, you should allocate a portion of your monthly income to these expenses.

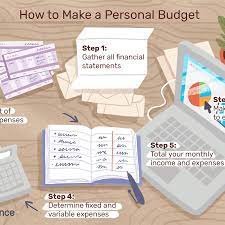

After you have determined your monthly spending and income, you should create a spreadsheet that contains all of your categories. Make sure to note your fixed and variable expenses. If you don’t have internet access, you can use a mobile app to create a spreadsheet that can be printed out. Your budget will contain information on all of your fixed and variable costs. You can also make notes on savings and investments. Your spreadsheet should include a column for debt repayment.

Once you’ve created the basic structure, you can break down expenses into categories. Once you have the total amount of your fixed expenses, you can then create a worksheet that lists your variable expenses. Using a spreadsheet will allow you to categorize each expense separately and easily. Once you’ve sorted out your fixed and variable costs, you can move on to the next step in creating a budget. You can also use an online template to make your budget more user-friendly.

The easiest way to do a budget is to break down the categories into three parts. The primary part of your budget should cover your needs. Your secondary part should cover your wants. For example, you can include the bills that you want to save for in the future. A good rule of thumb is to consider how much money you need and have to spend on these items. After you have done this, you can start working on your budget for the next month.

After you have a plan in mind, you should divide your expenses into categories. Then, you can add any variable expenses. If you have a fixed expense, you can list the amount of money that you want to spend in each category. You can also use a software to budget your spending. It is very important to keep in mind that the money that is left over after you’ve finished the process will go towards your savings.

Do a budget for the month that you need it for. When doing a budget, you should consider your expenses each month. If you make more money, you can cut back on expenses that are not necessary. You should also keep in mind that it is important to balance your spending. This will help you save more money and spend less. Your expenses should not exceed 30% of your income. If you have a smaller income than income, you should increase your savings to 20% of your total earnings.

You should keep in mind that your expenses are variable. You should consider reducing these to avoid overspending. You should not spend more than 20% of your income to pay off your debts. You can cut expenses by adjusting your priorities based on your income. This way, your budget will be more achievable. Once you’ve done your budget, you should keep your money in mind. This will help you make decisions that will help you avoid debts.

Before you do a budget, you need to make a plan for the following months. You should plan to keep up with your savings and income. If you have too many savings and investments, you should consider how much you spend on the rest. You can also take a look at your expenses and see where you can cut your expenditures. When you make a plan, you will see where you’re spending too much on a particular month.